- Barker Central School District

- Business Administrator

Business Office

Page Navigation

- Business Administrator

- Business Office - Location & Hours of Operation

- 2025 Budget & Election Information

- Voter-Approved Tax Levy and Details on Paying Property Taxes

- Capital Improvement Project

- Budget Hearing Presentation, May 12, 2025

- Budget Notices

- Tri-component Budgets

- Facility Use Form/Agreement

- Federal Covid Assistance Documents

- Financials and Related Documentation FYE 2014-2024

- Foil Requests

- District Contracts

- Property Tax Report Cards

- Tax Warrant

BUSINESS ADMINISTRATOR - LETTER TO COMMUNITY

-

Hello Barker Learning Community.

We are quickly approaching our annual budget vote. This article contains some information regarding the 2025-2026 budget.

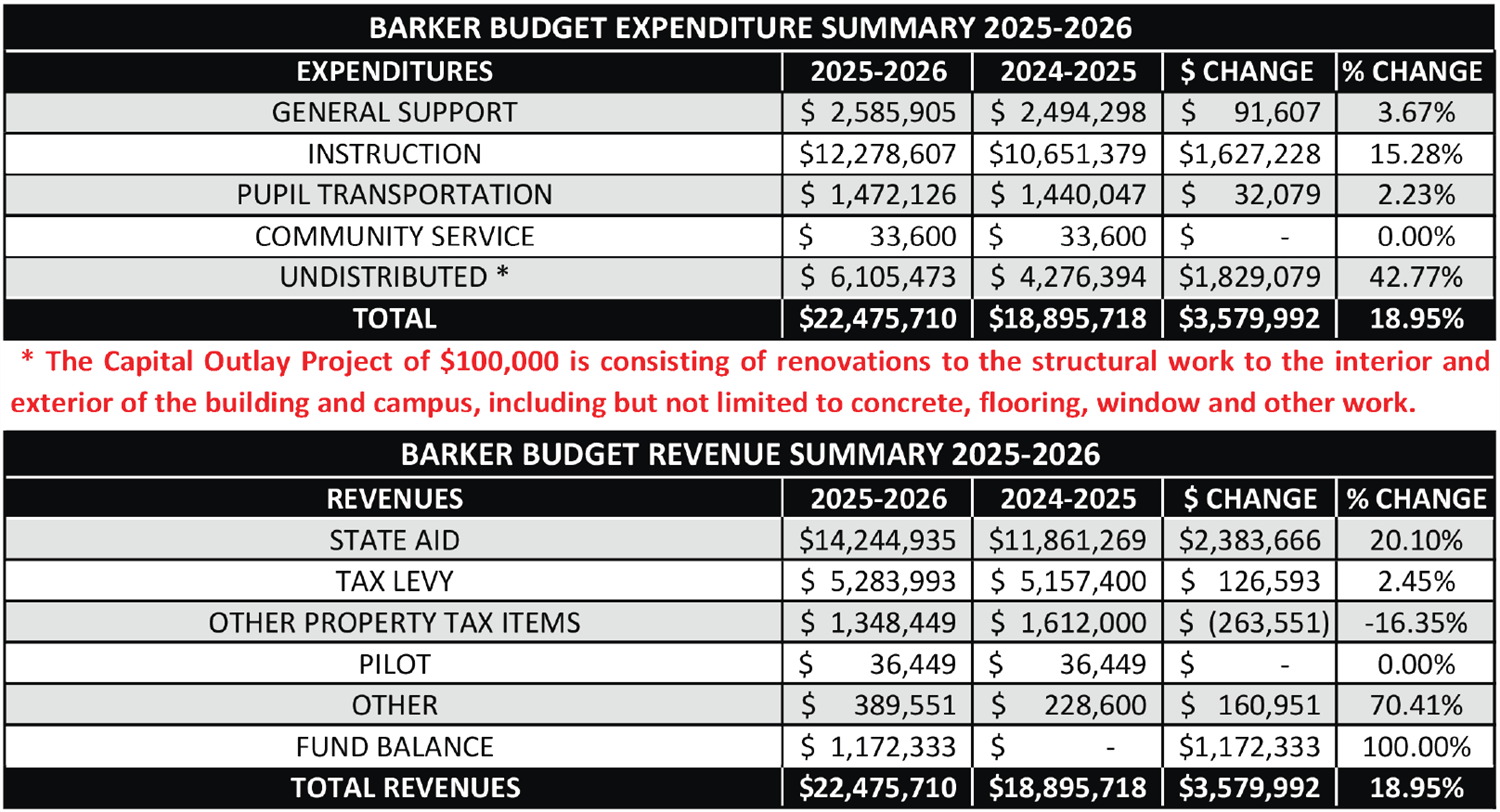

The total budget for the 2025-2026 school year is $22,475,710. Below is a chart that shows the year over year changes to our budget.

The District is proposing a tax levy of $5,283,993. This represents a 2.45% increase above the 2024-25 school year. This amount is the allowable tax levy limit that would only require a simple majority vote to pass. Assuming there are no changes in the values of the towns, tax rates for homeowners would increase by approximately 2.45%.

The reason the budget is increasing by 18.95% is twofold: special education tuition costs have increased, but we receive a higher amount of state aid for these costs. Also, debt service is increasing for the capital project, which is offset by building aid from the state. Neither of these items is having an impact on local property taxes due to the aid we receive from New York State.

We encourage District residents who wish to learn more about the budget to attend the public hearing on Monday, May 12th at 6:30 pm in the auditorium. The annual vote will be held on Tuesday, May 20th from 12:00 pm to 8:00 pm in the auditorium.

If you have any questions please do not hesitate to reach out. Thank you for your continued support of the School District.

Sincerely,

Michael Carter

Business Administrator

mcarter@barkercsd.net